Grasping Insurance Concepts: Protecting Your Future and Financial Assets

Knowing about insurance is essential for anyone seeking to safeguard their monetary future. It provides a safety net against unexpected events that could lead to significant losses. Many different forms of insurance are available, each designed for different needs. However, many individuals struggle with determining the right amount of coverage or understanding the fine print of the agreement. The complexities of insurance can create uncertainty, requiring a more transparent view of how to safeguard assets effectively. What factors should people weigh prior to finalizing their choice?

Fundamental Insurance Concepts: Essential Information

Insurance serves as a financial safety net, protecting individuals and businesses against unexpected dangers. It is fundamentally a contract linking the customer and the company, where the customer pays a regular charge for receiving fiscal security against specific losses or damages. At its core, insurance is about handling risk, allowing individuals to transfer the burden of possible monetary damage onto a provider.

Coverage agreements detail the rules and stipulations, detailing what is covered, what is excluded, and how to report a loss. The idea of combining funds is key to insurance; numerous people contribute to the scheme, allowing for the funding of claims for individuals who suffer setbacks. Understanding the basic terminology and principles is crucial for choosing wisely. In sum, coverage aims to offer security, ensuring that, in times of crisis, people and companies are able to bounce back and move forward successfully.

Different Forms of Coverage: A Detailed Summary

Numerous forms of coverage are available to meet the varied requirements for people and companies alike. The most popular types include health coverage, that pays for healthcare costs; motor insurance, shielding against automobile harm; and homeowners insurance, safeguarding property against hazards like burning and robbery. Life insurance offers financial security for dependents if the insured passes away, and coverage for disability replaces wages if one becomes unable to work.

For companies, professional indemnity shields from accusations of wrongdoing, while commercial property coverage protects tangible goods. Professional indemnity insurance, or simply errors and omissions insurance, shields professionals against lawsuits stemming from omissions in their services. Moreover, travel insurance provides coverage for unforeseen incidents during travel. All insurance policies is fundamental to managing risks, ensuring individuals and businesses can mitigate potential financial losses and ensure stability during unpredictable times.

Evaluating Your Coverage Requirements: How Much Coverage Is Enough?

Determining the appropriate level of necessary protection demands a meticulous appraisal of asset value and potential risks. People need to evaluate their financial situation and the property they want to safeguard to arrive at an adequate coverage amount. Good strategies for assessing risk are crucial for ensuring that one is not insufficiently covered nor overpaying for unnecessary coverage.

Appraising Your Possessions

Evaluating asset value is a crucial stage in understanding how much coverage is necessary to achieve adequate insurance coverage. This process involves establishing the price of private possessions, property holdings, and monetary holdings. Those who own homes need to weigh elements like the present economic climate, the cost to rebuild, and asset decline when appraising their property. In addition, one must appraise personal belongings, cars and trucks, and any liability risks linked to their possessions. Through creating a comprehensive list and appraisal, they can identify possible holes in their protection. In addition, this evaluation helps individuals adjust their coverage to meet specific needs, providing proper safeguarding against unforeseen events. In the end, accurately evaluating asset value lays the foundation for smart coverage choices and economic safety.

Approaches to Risk Analysis

Developing a full knowledge of asset worth logically progresses to the following stage: determining necessary insurance. Methods for assessing risk include identifying potential risks and figuring out the right degree of insurance required to mitigate those risks. The evaluation commences with a full accounting of property, including property, cars, and private possessions, in addition to an evaluation of future obligations. The person needs to evaluate factors such as location, lifestyle, and risks relevant to their profession that could impact their insurance requirements. In addition, checking existing coverage and pinpointing missing protection is necessary. By measuring potential risks and connecting them to the worth of assets, you can make educated choices about the required insurance type and quantity to safeguard their future effectively.

Interpreting Coverage Jargon: Key Concepts Explained

Grasping the language of policies is essential for navigating the intricacies of insurance. Core ideas like types of coverage, insurance costs, deductibles, exclusions, and restrictions play significant roles in assessing a policy's efficacy. A solid understanding of these terms assists consumers in making sound judgments when picking insurance choices.

Types of Coverage Defined

Insurance policies come with a selection of different coverages, every one meant to cover certain requirements and dangers. Common types include coverage for liability, which guards against lawsuits; coverage for property, safeguarding physical assets; and personal injury coverage, which addresses injuries sustained by others on one’s property. Additionally, broad coverage provides security against a broad spectrum of dangers, like natural catastrophes and stealing. Niche protections, such as professional liability for businesses and health insurance for individuals, adjust the security provided. Understanding these types helps policyholders choose the right coverage based on their specific situations, ensuring adequate protection against potential financial losses. Each form of protection is essential in a extensive insurance strategy, leading to fiscal stability and tranquility.

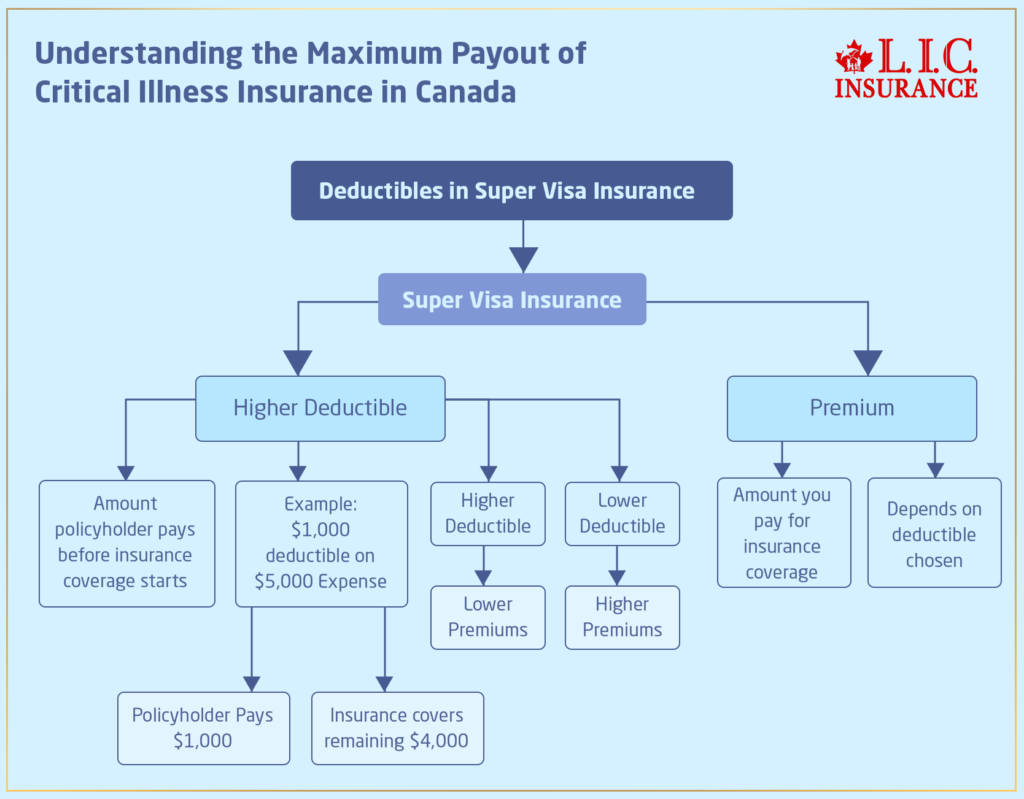

Insurance Costs and Out-of-Pocket Limits

Selecting the right coverage types is just one aspect of the insurance puzzle; the monetary elements of deductibles and premiums significantly impact coverage choices. Premiums represent the cost of maintaining an insurance policy, typically paid monthly or annually. A greater premium often indicates more extensive coverage or reduced out-of-pocket costs. Conversely, deductibles are the sums the insured must cover personally before their coverage begins to apply. Choosing a higher deductible can lower premium costs, but it may lead to greater financial responsibility during claims. Understanding the balance between these two elements is vital for those aiming to protect their assets while handling their finances efficiently. Crucially, the interplay of the costs and payouts determines the total benefit of an insurance policy.

Limitations and Exclusions

Which components that can hinder the efficacy of an insurance policy? Exclusions and limitations within a policy specify the conditions under which coverage is not provided. Examples of exclusions include prior medical issues, acts of war, and certain types of natural disasters. Restrictions can also pertain to specific coverage amounts, necessitating that policyholders grasp these restrictions in detail. These elements can considerably affect claims, as they determine what financial setbacks will not be compensated. find here Policyholders must read their insurance contracts closely to find these restrictions, so they are well aware about the extent of their coverage. A clear grasp of these terms is crucial for effective asset protection and long-term financial stability.

Filing a Claim: What to Expect When Filing

Filing a claim can often be confusing, especially for those unfamiliar with the process. The starting point typically involves notifying the insurance company of the incident. This can usually be done through a telephone call or digital platform. After the claim is filed, an adjuster may be appointed to evaluate the situation. This adjuster will examine the specifics, collect required paperwork, and may even go to the incident site.

Once the review is complete, the insurer will decide on the legitimacy of the claim and the payout amount, based on the contract stipulations. Claimants should expect to provide supporting evidence, such as receipts or photos, to facilitate this evaluation. Communication is essential throughout this process; you may have to contact with the insurer for updates. In the end, knowing the claims procedure helps policyholders navigate their responsibilities and rights, making sure they get the payment they deserve in a prompt fashion.

Tips for Choosing the Right Insurance Provider

How do you go about finding the most suitable insurance provider for their situation? To begin, people must evaluate their particular needs, looking at aspects such as the kind of coverage and financial limitations. It is crucial to perform comprehensive research; online reviews, ratings, and customer stories can provide insights into customer satisfaction and how good the service is. Additionally, soliciting pricing from various companies allows one to compare premiums and coverage specifics.

It's wise to check the financial stability and credibility of potential insurers, as this can impact their ability to pay claims. Talking with insurance professionals can help explain the policy's rules, ensuring transparency. Moreover, looking for potential savings or bundled services can increase the worth of the policy. Finally, seeking recommendations from trusted friends or family may lead to discovering reliable options. By following these steps, individuals can make informed decisions that are consistent with their insurance needs and monetary objectives.

Remaining Current: Maintaining Current Coverage

After selecting the right insurance provider, individuals must remain proactive about their coverage to guarantee it meets their shifting necessities. It is crucial to check policy specifics often, as shifts in circumstances—such as marriage, acquiring property, or professional transitions—can impact coverage requirements. People ought to arrange yearly meetings with their insurance agents to talk about necessary changes based on these life events.

In addition, staying informed about industry trends and shifts in policy rules can give helpful perspectives. This information might uncover new coverage options or discounts that could enhance their policies.

Keeping an eye on the market for better prices may also help find more economical choices without compromising security.

Frequently Asked Questions

How Do Insurance Premiums Vary With Age and Location?

Insurance premiums typically increase with age due to greater potential hazards associated with aging people. In addition, where you live affects pricing, as metropolitan regions tend to charge more due to a greater likelihood of accidents and crime compared to country areas.

Is it possible to switch my current insurer before the policy expires?

Absolutely, people are able to switch their insurer during the policy term, but they need to examine the details of their existing coverage and guarantee they have new coverage in place to avoid gaps in protection or associated charges.

What occurs if I fail to make a insurance installment?

When a policyholder skips a required insurance payment, their policy might expire, resulting in a possible lack of coverage. Reinstatement might be possible, but may necessitate paying outstanding premiums and could include fines or more expensive coverage.

Will existing health problems be covered in health plans?

Pre-existing conditions may be covered in health insurance, but the extent of protection differs per policy. Many insurers impose waiting periods or exclusions, though some grant coverage right away, stressing that policy details must be examined completely.

How Do Deductibles Affect My Insurance Costs?

Deductibles affect the price of insurance by establishing the figure a holder of the policy is required to spend before coverage kicks in. Higher deductibles typically result in lower monthly premiums, while lower deductibles lead to higher premiums and potentially less out-of-pocket expense.